navy federal refinance auto loan calculator

For example if the seller has a 200000 loan balance on a 300000 home the buyer will need to bring 100000 to the table to compensate the seller for the equity they. One of the best reasons to refinance is to lower the interest rate on your existing loan.

Capital One Auto Loans Review 2022

Well look at some steps you can take to shop for an auto loan that may help lower the cost of financing a vehicle as well as review our picks for auto lenders that offer car loans for bad credit.

. On average our members save 62 per month by refinancing their auto loan with Navy Federal. Disability and Prior VA Loan Use. If youre VA disabled have a purple heart or are a military spouse youre exempt from the VA funding fee - typically 23 percent of the loan amount.

Navy Federal Credit Union NFCU offers personal loans between 250 to 50000 to its members. Student loan calculator. Best Student Loan Refinance Lenders.

Like other lenders the best auto loan rates and most flexible terms go to those who buy or refinance the newest cars. Heres a closer look at what that means by loan type at USAA. If the house has gained value since the original loan was issued the buyer will need to cover that difference also known as equity with cash or another loan.

USAA auto loan rates and terms. The average auto loan rate for a new car was 407 in the first quarter of 2022 while the typical used-car loan carried an interest rate of 862 according to Experians State of the Automotive. Homebuyers whove used a VA loan before and arent exempt from the VA funding fee typically pay a higher VA funding fee - generally 36 percent of the loan amount.

Whether youre looking to buy a new or used car or even want to refinance your auto loan from another lender were here to help. Borrowers buying or refinancing 2020 and newer vehicles at a 60-month or lower term qualify for the lowest rates. We offer auto loans with great rates 100 financing and exclusive military discounts 1 often with decisions in seconds.

Cheapest States To Buy A Car Auto Loan Calculator. By comparison the average interest rate on a 60-month new-car loan was 514 during that same period according to the Federal Reserve. Savers will need to deposit at least 10000 to earn the.

Thats more than 700 per year in savings. PenFed offers terms from 36 to 84 months and auto loans between 500 and 150000 which could make them a good option if you need to finance a smaller amount. Refinancing your car loan from another lender with Navy Federal may help you lower your interest rate decrease your monthly payment or pay off your car loan sooner.

Regardless if you make 500000 per year or 50000 per year VA lenders underwrite your loan in the exact same manner as it addresses debt to income ratios and affordability. Navy Federal Credit Union is the worlds largest credit union with. Historically the rule of thumb is that refinancing is a good idea if you can reduce your interest rate by.

Unlike the Basic Savings account Navy Federals Money Market Savings Account pays a yield that varies based on the size of your deposit.

Navy Federal Credit Union Nfcu Auto Loan Approval Process Otosection

Car Repossession How It Works Car Loan Calculator Car Loans Refinance Car

How To Get Pre Approved For An Auto Loan Otosection

This Spring Clean Up And Clear Out Your Car Of Any Clutter Or Dirt These Top Five Tips For Spring Cleaning Your Car Will L Clean Your Car Spring Cleaning Car

780 Car Loan Stock Photos Pictures Royalty Free Images Istock

New Vs Used Auto Loans A Quick Comparison For Car Buyers Roadloans Car Car Buyer Car Buying

The Basics Of Refinancing Your Auto Loan Navy Federal Credit Union

Navy Federal Auto Loans Review 2022

What Is The Average Car Payment And What Can You Afford Roadloans Car Payment Car Finance Mortgage Tips

9 Easiest Auto Loans To Get 2022 Badcredit Org

Car Financing And The Car Buying Process Navy Federal Credit Union

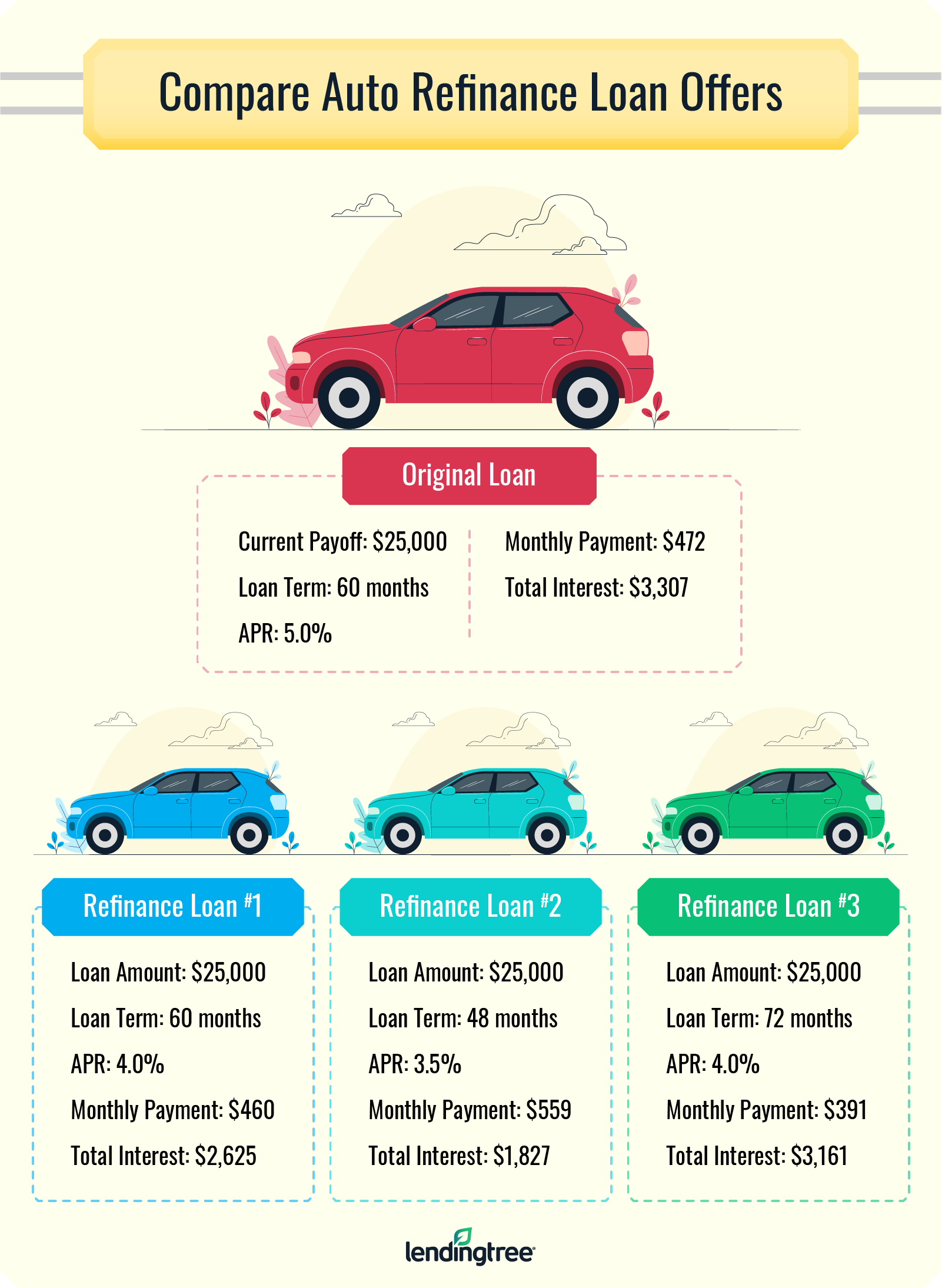

How To Refinance A Car Loan In 5 Steps Lendingtree